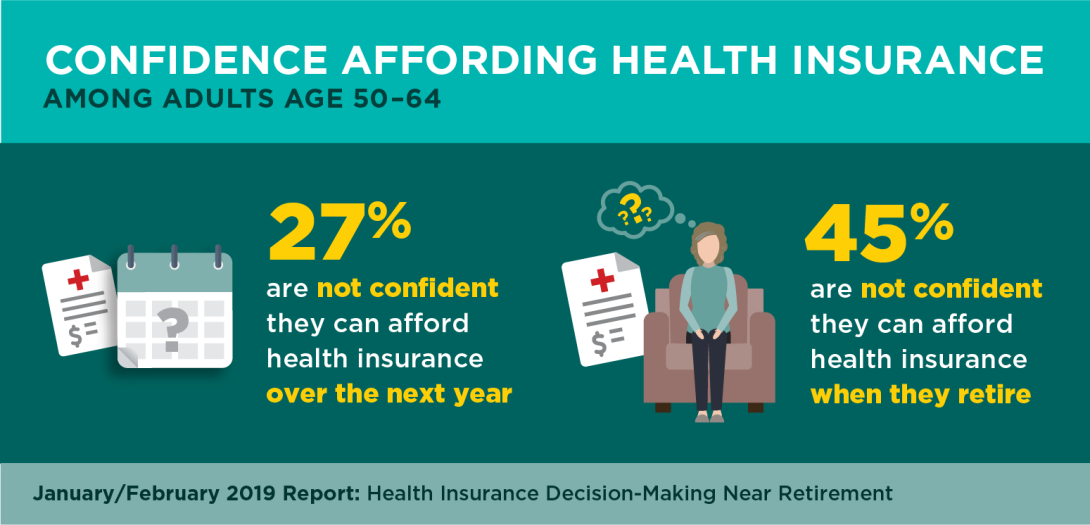

Almost half of Americans ages 50 to 64 are worried they won’t be able to afford insurance in retirement, and 68 percent are concerned about federal changes to health insurance.

7:01 AM

Author |

With the dawn of a new year, most Americans have just started a new health insurance coverage period — whether they receive their coverage through a job, buy it themselves or have a government plan.

But a new national poll suggests that many people in their 50s and early 60s harbor serious worries about their health insurance status, now and in the future.

LISTEN UP: Add the new Michigan Medicine News Break to your Alexa-enabled device, or subscribe to our daily audio updates on iTunes, Google Play and Stitcher.

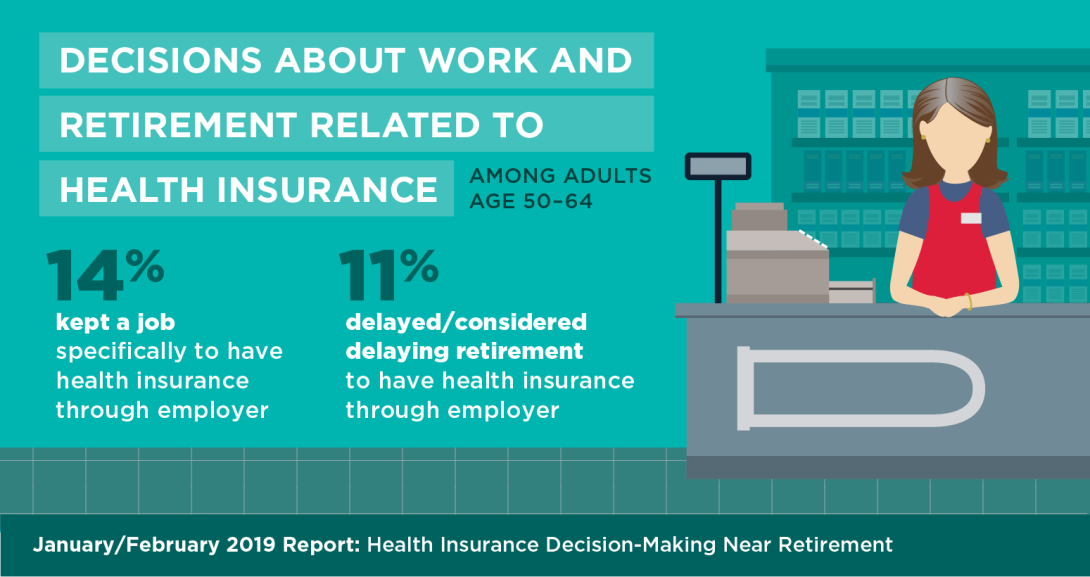

Forty-five percent of Americans ages 50 to 64 say they have little or no confidence that they'll be able to afford health coverage once they retire. And 27 percent said they're not sure they'd be able to afford their coverage over the next year. One in 10 said they'd thought about going without health insurance for 2019, though only 5 percent had decided to do so at the time of the poll.

An additional 19 percent of adults in this age group said they decided to stay in their current job rather than change jobs or retire, just to keep their job-related coverage.

For those who changed coverage for 2019, 15 percent said they were postponing medical procedures until their new coverage kicked in. And 8 percent of those in their early 60s are putting off medical procedures until they're eligible for Medicare at age 65.

MORE FROM MICHIGAN: Sign up for our weekly newsletter

The findings from the National Poll on Healthy Aging also indicate that half of adults ages 50 to 64 closely follow the news about possible changes to the Affordable Care Act, Medicare or Medicaid.

The poll was conducted well before a December court ruling about the Affordable Care Act's constitutionality — but 68 percent already said they were concerned about how potential federal policy changes might affect their health insurance.

SEE ALSO: Half of Older Adults Don't Use Patient Portals for Health Care

The poll of 1,024 adults in their pre-Medicare years was conducted by the University of Michigan Institute for Healthcare Policy and Innovation and sponsored by AARP and Michigan Medicine, U-M's academic medical center.

Renuka Tipirneni, M.D., M.Sc., a U-M health researcher who helped lead the poll design and analysis, notes that the closer adults get to retirement, the more important it is for them to understand options for coverage and associated costs.

"As people age into the years when many chronic diseases begin to take hold and when they're still years away from Medicare coverage, it's important to talk with someone knowledgeable about all the options for coverage to bring down out-of-pocket costs and better navigate health care in this critical period," says Tipirneni, a general internist who studies the public's health insurance knowledge and use.

Sources of insurance

The poll focuses on people approaching the "magic" age of 65, when most Americans qualify for Medicare health insurance. It was conducted in the fall, during the open enrollment period for many employer insurance plans and near the start of open enrollment for Medicare and plans available to individuals on federal and state marketplace sites.

Nearly two-thirds of those polled said their health insurance comes through their job or another person's job. About 20 percent had Medicaid, Medicare or another government-provided insurance, and 8 percent said they buy their own coverage.

"The Affordable Care Act was intended to cut down on 'job lock,' where a person feels trapped in their job by their need to preserve their health insurance," says Preeti Malani, M.D., director of the poll and a professor of internal medicine at the U-M Medical School.

SEE ALSO: Study: Medicare Coverage Limits Put Seniors' Vision Needs at Risk

"We were surprised by the low percentage of these adults who bought their own coverage through the ACA exchange and the relatively high percentage who felt they had to keep a job or delay retirement in order to keep a plan," Malani says. "Innovative policy solutions are needed to help adults in this age group navigate their insurance options."

Health policy implications

Worry about the ongoing debate over changes to the ACA, Medicaid and Medicare — whether through congressional voting, presidential action or court rulings — could be driving some of these decisions.

"This survey validates that health care coverage is a top concern of older Americans," says Alison Bryant, Ph.D., senior vice president of research for AARP. "The uninsured rate among the 50- to 64-year-old age group dropped 47 percent since implementation of the ACA, but we have to continue to improve access and affordability of health coverage for all older adults."

Understanding insurance

The poll also asked respondents about their understanding of health insurance terms, where they got information about health insurance, and their level of confidence that they could find out what their insurance covered or what services would cost them.

In all, 1 in 5 polled said they had little or no confidence that they could understand insurance terms. About 1 in 4 said they didn't think they knew how to find out what their insurance plan would cover before they received a health care service or what their out-of-pocket costs would be.

Recently, Tipirneni and colleagues published a study about the link between people's confidence in understanding their health insurance policies and their tendency to avoid health care because of cost.

The work, published in JAMA Network Open, found that nearly 30 percent of insured adults over age 18 avoided seeking certain types of care because of the potential costs for them. Those with the least confidence in their understanding of common health insurance terms were more likely to say they had avoided preventive or nonpreventive care because of cost.

The National Poll on Healthy Aging results are based on responses from a nationally representative sample of 1,024 adults ages 50 to 64 who answered a wide range of questions online. The IHPI team wrote the questions and interpreted and compiled the data. Laptops and internet access were provided to poll respondents who did not already have them.

Explore a variety of healthcare news & stories by visiting the Health Lab home page for more articles.

Department of Communication at Michigan Medicine

Want top health & research news weekly? Sign up for Health Lab’s newsletters today!