For the first time, researchers show how much patients with private insurance actually pay for hospital stays. Costs are high, and rising fast, depending on plan design.

2:53 PM

Author |

Even with what's thought of as good health insurance, hospital stays can cost patients more than $1,000 out of pocket.

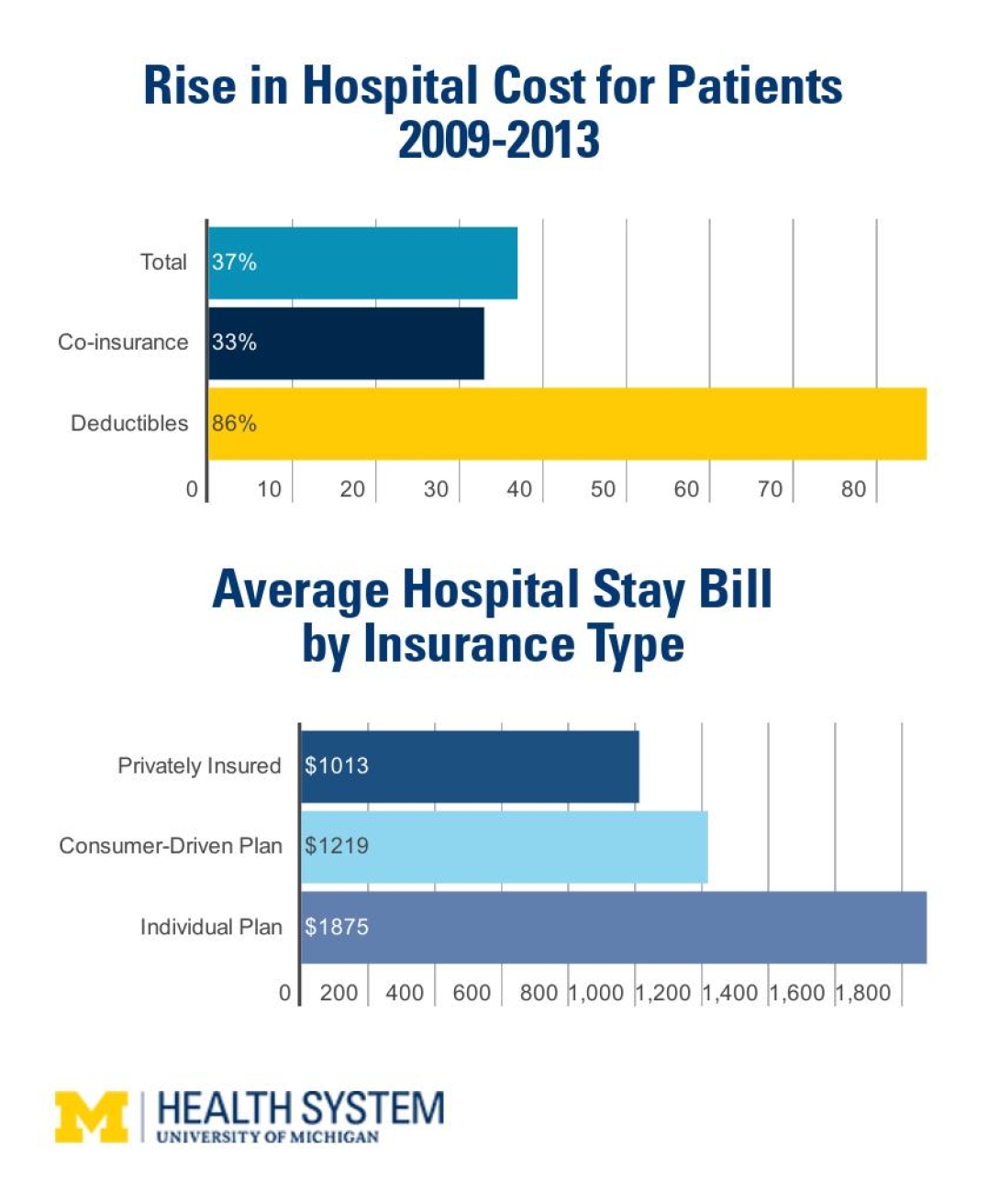

And that amount has risen sharply in recent years: more than 37 percent just for straightforward hospital stays for common conditions.

SEE ALSO: How Smarter Insurance Design Can Curb Sickness and Cut Costs

These striking statistics come from the first published analysis of actual out-of-pocket spending by people with private health insurance, typically employer provided. The study appears in JAMA Internal Medicine and is being presented at the AcademyHealth Annual Research Meeting in Boston.

To see the increase in costs paid by privately insured hospital patients, researchers at the University of Michigan's Institute for Healthcare Policy and Innovation examined data from more than 50 million Americans over a four-year period.

All of them had insurance plans offered by the three major companies that pool their data with the Health Care Cost Institute, of which the Institute for Healthcare Policy and Innovation is an academic partner.

The biggest change in out-of-pocket spending came from two types of insurance plan charges: one familiar to patients and one that may come as a surprise.

Deductibles — the amount that patients pay for their care before their insurance kicks in — rose by 86 percent. Co-insurance — a percentage of the cost of the hospital stay that insurance plans often expect patients to pay, but patients may not even realize they will owe — rose 33 percent.

"These results open up the black box of health care, and show all the costs of hospitalization that are billed to people with private insurance. For many, these may appear to be hidden costs that they didn't realize they would owe," says first author Emily Adrion, Ph.D., M.Sc., a U-M research fellow with the Center for Healthcare Outcomes and Policy. "It shows that even people with the most comprehensive insurance are paying thousands of dollars at a time when they need hospital care and may not have time to shop around."

She and her colleagues, including senior author Brahmajee Nallamothu, M.D., MPH, note that the growth in out-of-pocket costs was 6.5 percent a year, compared with a 5.1 percent growth in health insurance premiums and a 2.9 percent growth in overall health care spending. (See a video explaining the changing costs here; article continues below.)

High costs, high variation

The study looked at costs billed to people between the ages of 18 and 64 from 2009 to 2013. In addition to a broad-based analysis, the researchers took a closer look at those who had heart attacks, pneumonia, appendicitis, heart bypasses, total knee replacement or spinal fusion procedures, and women who gave birth.

This differs from other studies that instead estimated out-of-pocket spending based on the design of insurance plans.

The percentage of patients who were charged deductibles and co-insurance rose by more than five percentage points during the study period.

SEE ALSO: Medicaid Expansion Brings Hospitals Across-the-Board Relief

Copayments, which are different from co-insurance and are a kind of entry fee to a hospitalization, actually fell during this time. But this was because fewer insurance plans charged a copay for a hospital stay in 2013 than had charged one in 2009 — not because of an actual drop in the dollar amount of the copays charged to patients.

The study also reveals sharp differences in out-of-pocket costs for people who chose consumer-directed health plans offered by their employers — which often take the smallest bite out of each paycheck — and for people who bought individual private plans during the study period.

For those with consumer-directed plans, the total owed after a straightforward hospital stay topped $1,200 on average. Employers also may have offered patients a way to save pretax dollars in a special account to help pay this cost, but the study data don't show that.

For those with individual private plans, the cost was $1,800 on average. Adrion notes that to qualify for an individual private plan during the study period, patients would have to have met standards for good health. A provision mandating that plans cover all adults regardless of pre-existing conditions didn't take effect until 2014.

"These results show the importance of reading the fine print when you choose a health insurance plan, and being prepared to spend more out of your own pocket after a hospitalization than you might have expected," says Nallamothu, a professor of internal medicine at U-M and a member of the Institute for Healthcare Policy and Innovation.

Patients can also make sure they understand which hospitals and doctors are in network for their plan, which might mean lower co-insurance costs. And, for people who can't pay their entire bill at once, or at all, it means talking to the hospital about a payment plan or even a write-off of some costs under the hospital's charity care policy.

These results open up the black box of health care, and show all the costs of hospitalization that are billed to people with private insurance.Emily Adrion, Ph.D., M.Sc.

Next: looking at post-ACA trends

The study period didn't include private individual and family plans bought on the exchanges set up under the Affordable Care Act. Those plans began covering people in January 2014 and are open to anyone regardless of their health status. The study period, however, did include the first years when the ACA mandated that adults up to age 26 could remain on their parents' private health plans.

Recent estimates by the Kaiser Family Foundation suggest that the trend seen in these data has continued. According to a foundation report, 81 percent of people who get insurance through an employer have an annual deductible of about $1,300, and more than two-thirds also have co-insurance as part of their coverage. An even greater percentage of people who bought "silver" plans on an ACA exchange also have co-insurance provisions in their plans.

But plans bought on the ACA exchanges (including healthcare.gov) come with a federal cap on out-of-pocket spending of $6,800. Plans provided by employers, or bought individually outside the exchanges, don't have such a cap. Adrion and her colleagues plan to study future Health Care Cost Institute data to look at spending trends.

Explore a variety of healthcare news & stories by visiting the Health Lab home page for more articles.

Department of Communication at Michigan Medicine

Want top health & research news weekly? Sign up for Health Lab’s newsletters today!